When you put your house on the market, you want to sell it quickly and…

How Home Equity May Help You Buy Your Next Home in Cash

Building equity in your house is one of the biggest financial advantages of homeownership. And right now, homeowners across the country are sitting on record amounts of it.

Here’s a look at how that equity could be a game changer for you, and why it’ll flip your perspective from “Why would I move right now?” to “Why wouldn’t I?”

Home Equity: What Is It?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is valued at $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

Why Equity Is Such a Big Deal for Homeowners Looking To Sell

Recent data from the Census and ATTOM shows how significant today’s home equity really is. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

And that’s a big deal. Think about it: 2 out of 3 homeowners have at least 50% equity in their homes. To put a more tangible number on it so you can think about what that really means for someone like you, CoreLogic shows the average homeowner has $311,000 worth of equity built up. That kind of net worth can go a long way if you’re trying to make a move.

And that’s a big deal. Think about it: 2 out of 3 homeowners have at least 50% equity in their homes. To put a more tangible number on it so you can think about what that really means for someone like you, CoreLogic shows the average homeowner has $311,000 worth of equity built up. That kind of net worth can go a long way if you’re trying to make a move.

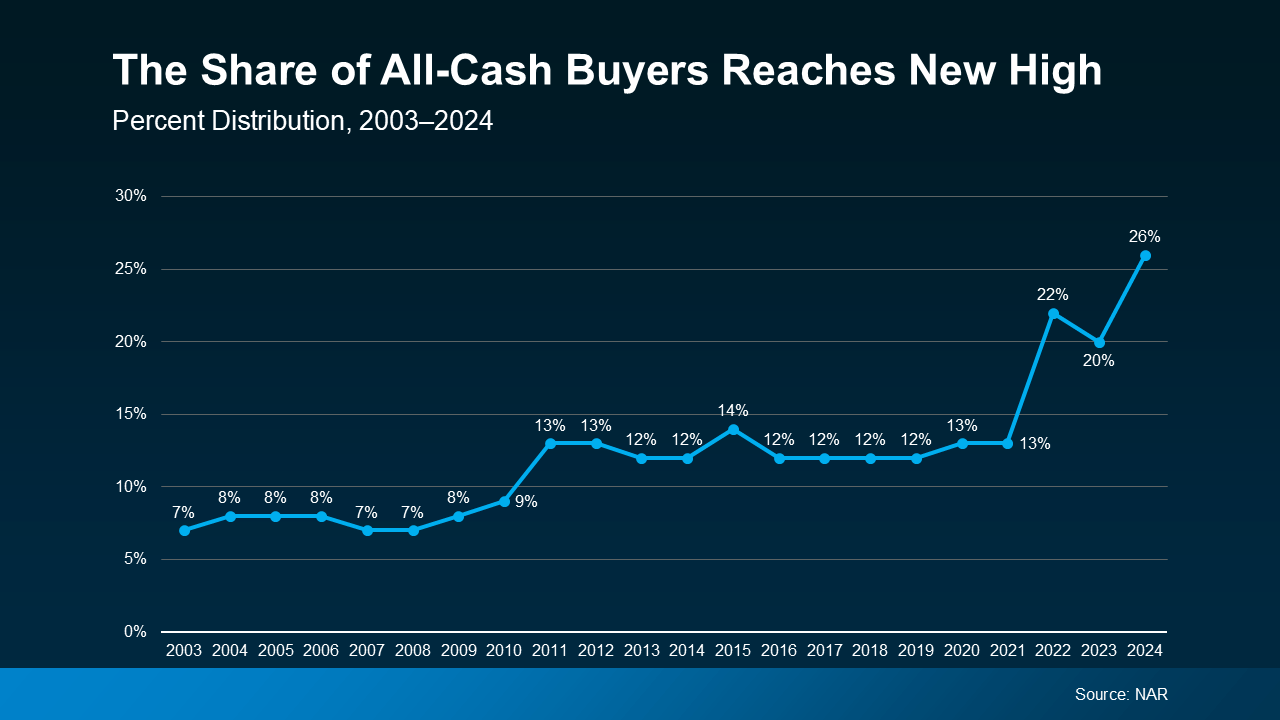

And that’s part of the reason why the share of all-cash buyers recently reached a new high. According to an annual report from the National Association of Realtors (NAR), 26% of buyers were able to buy without a mortgage (see graph below):

Who knows, you may find out you have enough equity to buy your next place outright– and with today’s mortgage rates, not having to take out a home loan is pretty incredible. Even if you don’t have enough equity to buy in all cash, you may still have enough to make a larger down payment, which has its own benefits too.

Bottom Line

Homeowners have an incredible amount of equity today – and that’s why the share of all-cash buyers is on the rise. To see how much equity you have and talk through how it can help fuel your next move, connect with an agent.